Understanding the Basics of 409A Valuation

Navigating the intricate landscape of financial valuation is essential for businesses, especially when it comes to the 409A valuation process. This guide aims to shed light on the fundamentals, offering a comprehensive understanding for both seasoned entrepreneurs and those new to the intricacies of business valuation.

What is a 409A Valuation?

To start, it’s crucial to grasp the concept of a 409A valuation. This specialized valuation method is named after section 409A of the Internal Revenue Code. It primarily focuses on determining the fair market value of a company’s common stock, a critical aspect for companies that issue stock options to their employees.

Importance of Accurate Valuation

Accurate valuation is not just a box to check for regulatory compliance; it plays a pivotal role in shaping the financial landscape of a company. A precise 409A valuation ensures that employees receive fair and reasonable stock options, fostering a positive work environment and promoting employee retention.

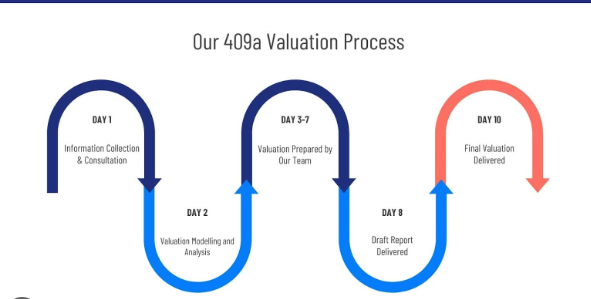

Navigating the 409A Valuation Process

Once the importance of a 409A valuation is clear, understanding the process becomes the next crucial step.

Engaging a Qualified Valuation Expert

The process begins with engaging a qualified valuation expert. These professionals bring a wealth of knowledge and experience to the table, conducting a thorough analysis of the company’s financials, market conditions, and other relevant factors. Choosing the right expert is paramount to a successful valuation.

Factors Influencing Valuation

Delving deeper, various factors come into play during the 409A valuation process. Market trends, financial performance, and industry benchmarks are just a few elements that contribute to determining the fair market value of the company’s common stock. Understanding these factors ensures a more nuanced approach to the valuation.

Challenges and Pitfalls to Avoid

Despite its importance, the 409A valuation process is not without its challenges.

Perplexities of Market Fluctuations

Market fluctuations can present a significant challenge in the valuation process. It’s crucial to navigate these perplexities with a keen eye on industry trends, economic shifts, and other external factors that may impact the company’s valuation.

Burstiness in Startup Dynamics

Startups, with their dynamic nature, often experience burstiness – rapid changes and developments. This can pose challenges in predicting future cash flows and assessing the company’s overall financial health. A skilled valuation expert understands how to address burstiness without compromising accuracy.

Conclusion: Navigating the Complexities with Confidence

In conclusion, demystifying the 409A valuation process requires a blend of expertise, understanding, and a proactive approach. By grasping the basics, navigating the process, and being aware of potential challenges, businesses can ensure a smoother valuation experience. Remember, a well-executed 409A valuation not only aligns with regulatory requirements but also serves as a strategic tool for fostering growth and retaining valuable talent.